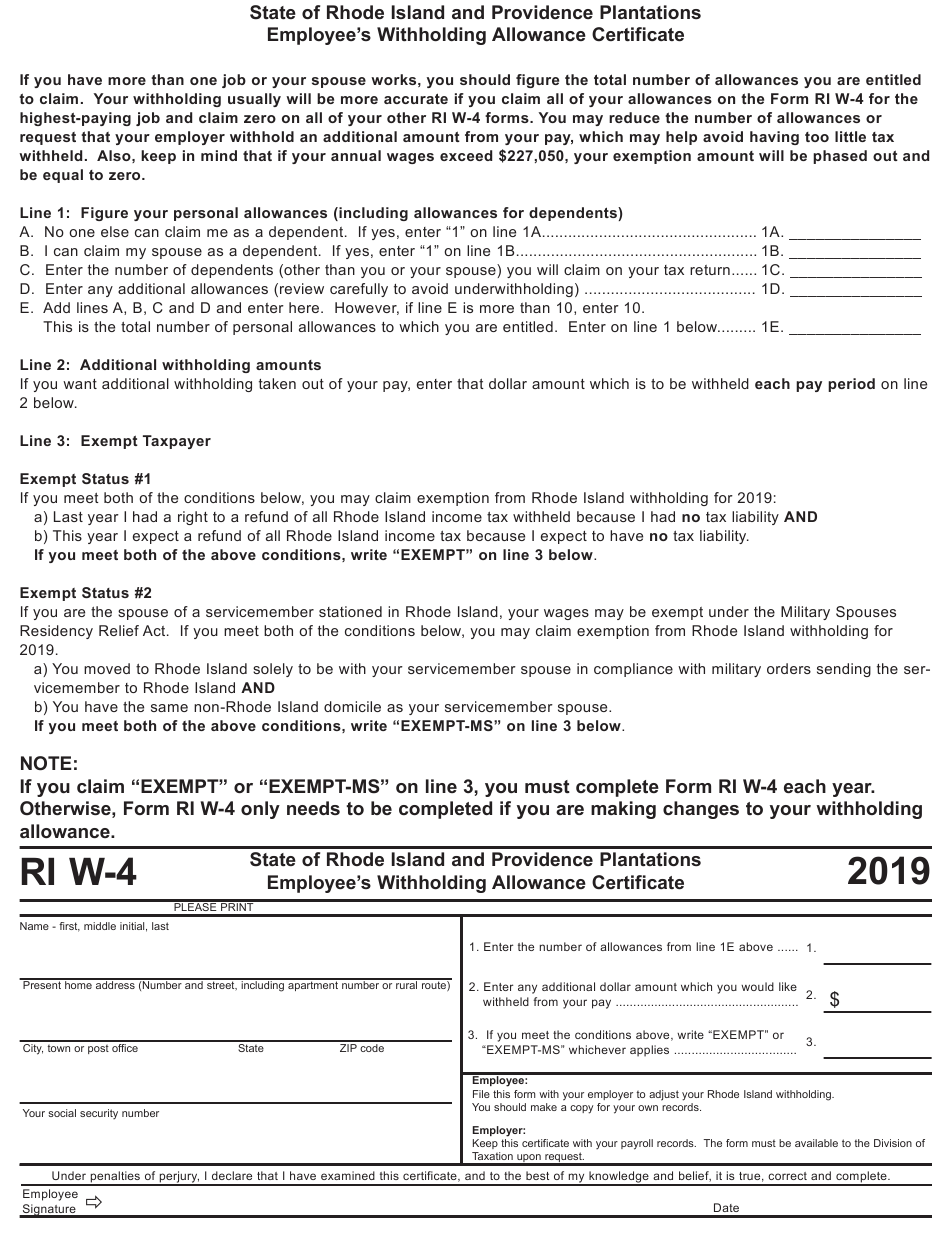

Table of Contents

W4 Employee Withholding Allowance Certificate 2021 – The W4 Form 2021, also referred to as “Employee’s Withholding Certificate”, is surely an IRS form that workers use to inform their employers how much tax they will withhold from each paycheck. Employers make use of the W4 Employee Withholding Allowance Certificate 2021 to compute particular payroll taxes, and to remit taxes for the IRS or even the state on behalf staff.

Should you have an present W-4 form, you don’t have to fill it out. A new W-4 isn’t necessary each year. The new W-4 will be needed if you are commencing a new occupation, or altering your withholdings at an existing work. It’s an excellent excuse for you to examine your withholdings.

The W-4 Form Continues To Be Updated

W4 Employee Withholding Allowance Certificate 2021. Employees utilized to be able to declare allowances on W-4 to scale back federal earnings tax withheld from wages. Employers would withhold much less from workers who claimed a lot more withholding allowances than they did. The 2017 Tax Cuts and Work Act modified a lot of tax principles. In addition, it eradicated personal exemptions. The IRS altered the W-4 form as a outcome.

In 2020, the brand new W-4 was released. It nevertheless requires simple private information, but does not inquire for almost any additional allowances. Workers who desire to reduce their tax withholding can now declare dependents or use the deductions worksheet.

How to Fill Out a W-4 Form

The IRS site has W4 Employee Withholding Allowance Certificate 2021. These are the steps to follow to determine if your scenario is roofed.

Step 1: Personal Information

Enter your name, address, and tax-filing status.

Step 2: Create An Account For Numerous Jobs

Follow the under instructions to determine how precise your withholding is if you’ve a lot more than one work or if you file jointly with your spouse.

Single and working multiple jobs or married filing jointly.

- A W-4 is needed for each and every work.

- Fill out the W-4 steps 2 through 4(b) to get the highest-paid work. For other work, depart those steps empty on the W-4s.

- In the event you are married and jointly file, you are able to tick a box to indicate simply how much you generate. This can be the trick: Each and every spouse need to do this on their W-4s.

You will find a couple of options in the event you don’t need your employer to understand that you simply have a very second job or that you make revenue from non-job sources.

- Line 4(c) allows you to instruct your employer that an additional quantity of tax be withheld from your paycheck.

- Alternativly, you can’t include the additional earnings in your W-4. Instead of having to pay tax immediately from your paycheck, ship the IRS approximated quarterly tax payments.

Step 3: Assert Dependents, Children Included

If your revenue is lower than $200,000, or $400,000 in the event you file jointly, you’ll be able to enter the amount of dependents and kids you have and multiply these through the credit sum. For more information regarding the child credit and whenever you can assert tax dependents, make sure you consult with the following.

Step 4: Alter Your Withholdings

You are able to reveal that you would like added tax withheld, or for being suitable for deductions past the regular deduction.

Step 5: Sign Your W-4 And Date It

After you have accomplished the form, ship it to your employer’s payroll or human resources crew.

What Do You Need To Know About A New W-4 Form?

Your employer will not deliver the IRS form W-4. The organization will file the W-4 after utilizing it to calculate your withholding. The new W-4 form is simply required if your employment changes in 2021, otherwise you desire to modify the amount withheld from you pay out.

You might have to amend your W4 Employee Withholding Allowance Certificate 2021 in the event you get married, divorced, incorporate a child to the family, or get up a second occupation. If you realize that your withholdings were also high or low the prior year, you may must file a fresh W-4. After your business updates your payroll info, your W-4 changes will likely be effective within one to three spend durations.

W4 Employee Withholding Allowance Certificate 2021

Loading...

Loading...