Table of Contents

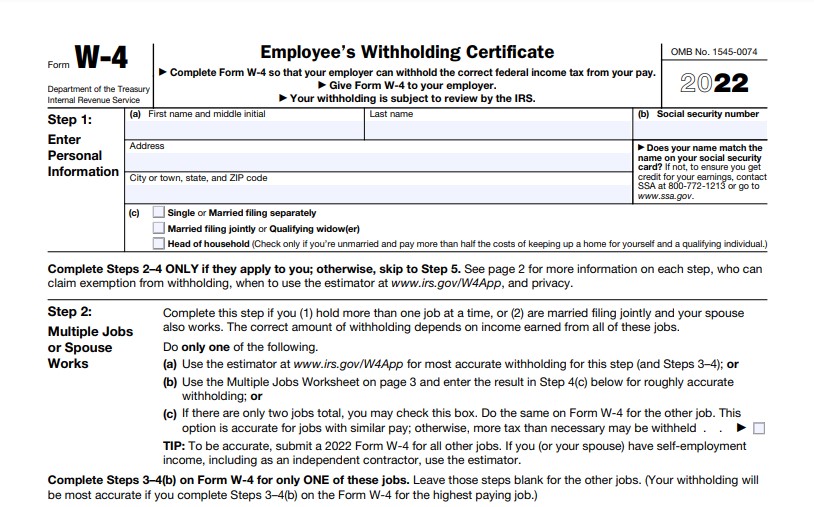

2022 W4 Form Printable, Fillable, Blank – When you begin a brand-new job, the W-4 tax form is called an Employee’s Withholding Certificate that your employer hands you.

What Is The 2022 W4 Form?

The 2022 W4 Form requires to be completed by all brand-new staff members as well as existing workers that wish to upgrade their withholding. The form makes your company may withholding the proper quantity of federal earnings tax obligation from your pay.

You do NOT require to upgrade the kind if you are delighted with your withholding and also you currently sent a W4 form to your company throughout a previous year. Just do so, if your tax obligation circumstance has actually altered.

When you submit your tax obligation return as well as might owe a fine, having actually as well little held back methods you’ll likely owe tax obligation. Have actually way too much kept and also you will normally schedule a reimbursement.

The redesign gets rid of allowances. This modification straightens with the adjustments from the 2017 Tax Cuts and Jobs Act. The adjustments make the Form easier to finish as well as less complicated for employees to precisely allow their company understands just how much tax obligation to keep.

When You Need a New W-4 Form?

Generally, your employer will certainly not send out form W-4 to the IRS. After utilizing it to determine your withholding, the firm will submit it. You only have to fill in the brand-new W4 form 2022 if you begin a new job in 2022 or if you wish to make changes to just how much is kept from your pay.

Some scenarios when you may require to transform your W-4 consist of marrying or separated, including a kid to your family members, or grabbing a sideline. You might additionally intend to send a brand-new W-4 if you find that you held back also little or also much the previous year when you’re preparing your yearly income tax return, and also you anticipate your situations to be comparable for the present tax obligation year. Your W-4 adjustments will certainly work within the following one to 3 pay durations– after your firm has actually upgraded your info in the payroll system.

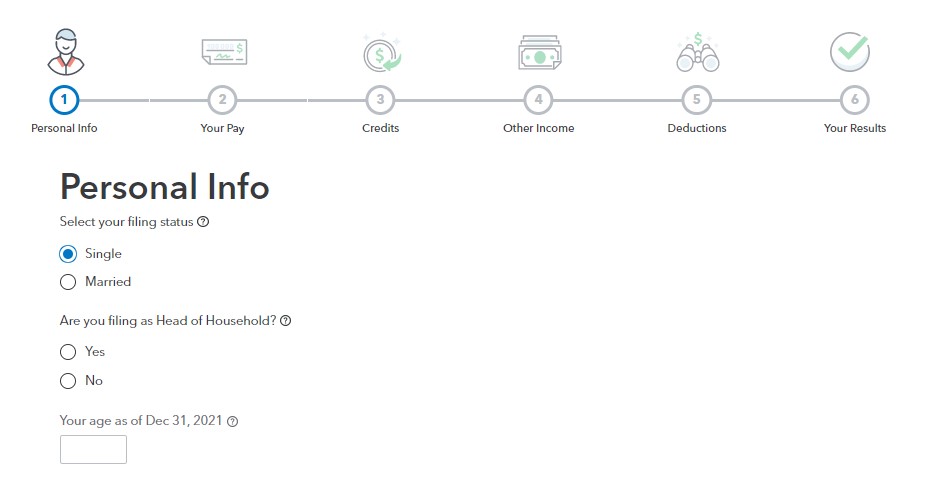

W-4 Calculator 2022 – You Can Calculate Your Taxes Easily

The W4 Calculator is the most convenient tool that can be used for the calculation of taxes. With the help of this wonderful tool, you can easily get the taxes which you need to pay and save money too. Using this tool, you can plug the figures given in the IRS W-4 form and you will get the result instantly. The W-4 calculator will also calculate the total payable and the total tax amount that you need to pay for the year.

You can also use this calculator for other tax calculations like the credits that you are going to claim on your taxes. It is also helpful in finding out the deductions that you are eligible for. This calculator not only helps you to calculate your tax but also helps you find out the deductions that you may qualify for. If you want to get professional help, you can also consult the IRS website for more assistance.

There are a lot of sites that offer W4 calculators for free. All you need to do is to type in your information regarding tax, minimum payment, interest rate, and earnings in the given fields and the calculator will provide the required results instantly. However, the accuracy of these calculators can not be guaranteed. There is also a possibility that the figures shown may not be correct. It is best to try the free tax calculation offered by various sites. You may also find some useful tips and information on the internet.

If you want to calculate your w-4 withholding, you can go through this link and fill all needed, until you get the results.

2022 W4 Form Printable, Fillable, Blank

Loading...

Loading...