Table of Contents

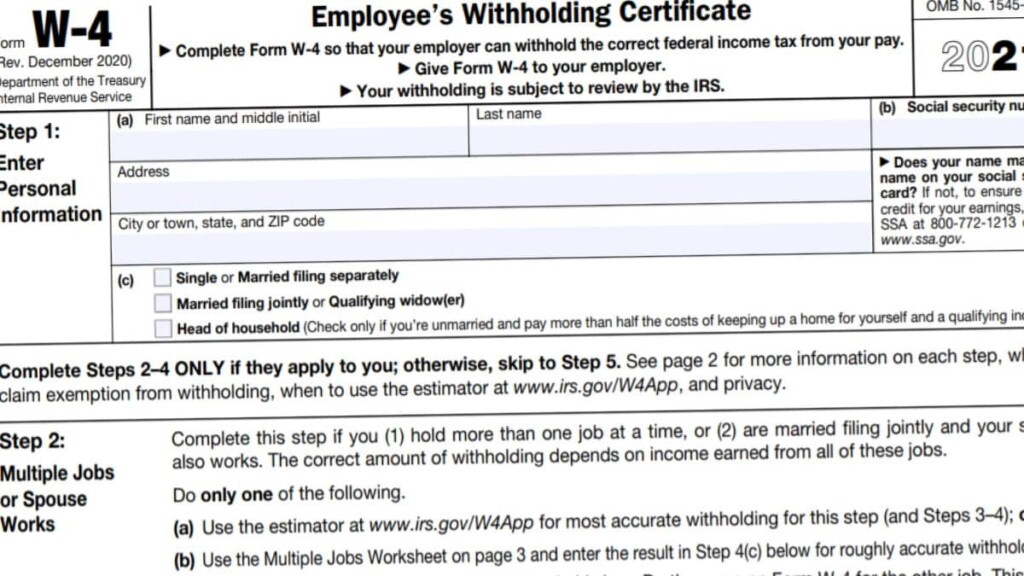

IRS W4 2022 – The 2022 W4 Form is a tax-related form that is issued from the Internal Revenue Service. It’s used to calculate the number of withheld funds from a payer’s pay for their federal income taxes. By filling out this form accurately, you can prevent owing tax balance or paying taxes in excess due to IRS.

What Is The Purpose of The 2022 W4 Form – IRS W4 Form?

A taxpayer who is eligible to be a citizen of an eligible taxpayer of the United States will be expected to pay taxes to the IRS upon earning income throughout the year. There are a variety of income categories that aren’t considered taxable, however, in the majority of cases there is a high probability that you will have to declare and pay your tax towards the Federal government.

To ensure that taxpayers pay the right amount of tax In order to ensure that the taxpayers pay the right amount of tax, the IRS will require paperwork each time they are employed to a new position. The paperwork includes the IRS W4 2022 it is the most crucial document in this matter. The IRS uses this specific document to receive relevant information regarding the taxpayer’s earnings. It is also used by employers to calculate the amount of federal income tax on each paycheck of their employees.

If you pay less government income tax that you’re required to pay can lead you to issues such as tax-related penalties and fines. However having a higher tax rate can result in a refund when you complete your tax filing process. While you may think that it’s good to get an amount of money back, it could signifies that you get more money in your pay. In turn, these extra funds will be incorporated into your yearly income tax bill you must prepare for the upcoming year’s tax return.

What Changes Made of The 2022 W4 Form – IRS W4 Form?

The past W4 Form was developed using the system of withholding allowances. It required taxpayers to submit a form when they needed to alter their tax withholding or enter with a new job. Since 2020 the IRS changed this method to lessen the complexity of how to calculate the amount of tax withheld from each pay check. The form itself was also adjusted to make it easier for taxpayers to comprehend and improve precision of the process.

The essential information carried by the IRS W4 2022 stays the same regarding what design you use. But, you might prefer the new form because it is simpler questions. By incorporating more straightforward worksheets, the possibility of reporting the amount of tax from the paycheck accurately is increased also.

Note that you have to complete an update to your IRS W4 2022 every time you experience an increase in income or a major alteration in your life. This will help you pay only the amount that you owe, which is beneficial in the long term. This can help you get a significant tax refund each year since tax withheld affects the tax refund directly.

W-4 Form 2022 Printable, Fillable

Loading...

Loading...