Table of Contents

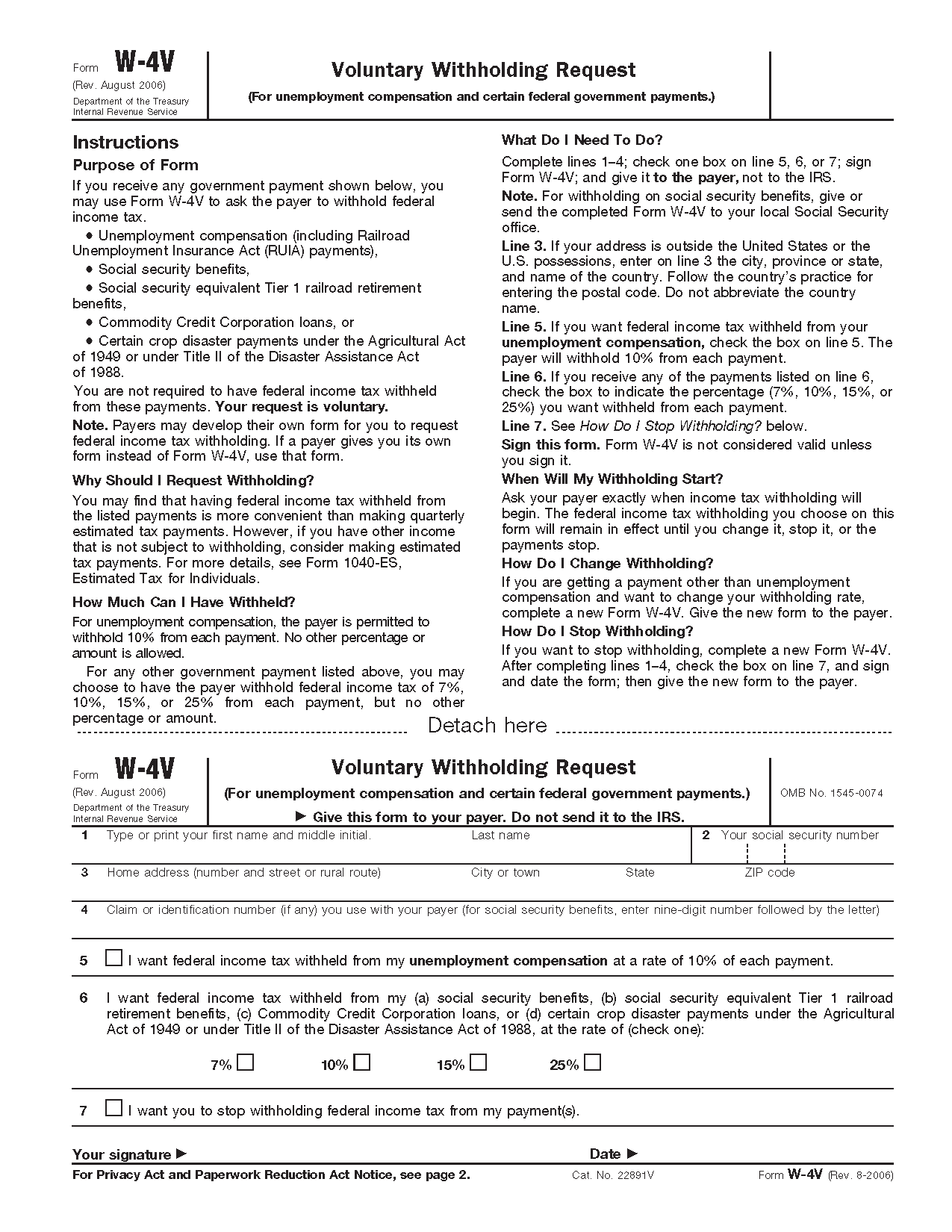

IRS W-4V Form 2021 – The IRS W-4V Form 2021 is used to request that your payer withholds federal income tax.

What is The W-4V Tax Form?

Voluntary withholding ask for, IRS Form W-4V is used to ask for that the payer withhold federal tax. Should you obtain one of those government advantages, it really is feasible to implement it:

- Social security advantages;

- The Tier 1 Railroad Retirement Advantages are equivalent to Social Security. These consist of annuities, unemployment-sickness and survivor applications that railroad employees and their families can access;

- Compensation for unemployment;

- Commodity Credit Company Loans-These loans are created by the Agriculture Department to take care of, stabilize and sustain farm incomes and agricultural rates;

- Alaska Indigenous Firms distribute dividends and other payments to shareholders;

- Crop disaster payments below Title II of either the Catastrophe Aid Act of 1998 or perhaps the Agricultural Act of 1949 – This monetary assistance is produced when a natural catastrophe results in inventory decline or stopped planting or bad yields;

- The Internal Revenue Service (IRS), issued probably the most current edition from the form, dubbed the IRS Voluntary Withholding request, on February 1, 2018. This rendered all previous versions out of date.

How Do I Complete the W-4V Form?

You might ask your payer to withhold federal taxes whenever you first seek out advantages or payment. You don’t need to do that, however you can full the W-4V Form in a later on time if you’d like to start withholding. This form allows you to set the withholding percentage that you want. It will stay in impact until finally payments quit or until finally you modify it by filling out a fresh form.

Here is the best way to fill out the IRS Voluntary withholding Request Form:

- You can also use this form to request withholding taxes. You could be needed to utilize the form supplied by your payer;

- The IRS should be submitted through the payer, and not to the IRS;

- To ask for that the social security payments be withheld, please submit a completed form W-4V to the nearby Social Security Administration office;

- You have to talk straight to your payer in order to figure out if the revenue tax withholding begins;

- You are able to modify your withholding rate by filing a fresh W-4V form or stop the method entirely.

Instructions For Filling Out the W-4V Form

- Remember to show your full lawful name and SSN;

- Consider a note of your residence address;

- Enter the declare number or identification number of the payer. This may be your social security number;

- You can show whether you’d probably like federal income tax to be deducted from unemployment payments. The payer will then deduct 10% from each and every payment;

- You can pick which share of additional government advantages you’d like withheld from your advantages, whether or not it is 7 percent, 10 %, 12 percent or 22 %;

- Should you wish to quit withholding, verify the right choice;

- You have to sign and date the form.

IRS W-4V Form 2021

Loading...

Loading...