Table of Contents

IRS Tax Forms 2020 Printable – Because the use of paper forms and papers proceeds to become a staple of business and industrial actions, there is a need for businesses to make usage of the W4 form printable. The W4 form printable is used to facilitate an employee’s withholding of tax cash too as other types of payroll transactions.

The W4 form can be used to file all required paperwork and forms pertaining to employee withholding. Should you certainly are a business that handles taxes for other people or other government agencies, then you will discover the W4 form printable to be very helpful.

Here are a few in the benefits that can originate from using this kind of paper form:

- Payroll

- Tax Savings

- Employee’s Withholding Certificate

- Wages

- Business Benefits

Payroll

Payroll – This can be something that may be really difficult for your employees to complete without assistance. With out knowing the best way to fill out these forms correctly, it is quite achievable the employee will not get paid in any respect. You’ll be able to stay away from any legal concerns in the event you know how to file these forms properly.

Tax Savings

Tax Savings – Once you understand how to handle payroll by yourself, then you should be able to save lots of funds on taxes. If you hire a payroll service, you are going to be liable for having to pay the payroll taxes on behalf of the organization. In the event you are an employer, then you must spend individuals payroll taxes by yourself. You will be able to save money with this sort of aid.

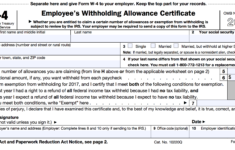

Employee’s Withholding Certificate

Employee’s Withholding Certificate – This form is a very essential one that each one employees will have to post after they become utilized. It really is essential for the company to make certain that their workers usually do not withhold funds in the company’s account. This could be a problem in the event the employee does not understand the correct approach to withhold. This can be also something that is extremely difficult to learn the best way to file for, since there are specific kinds of deductions that employees can make also as particular kinds of wages that may be deducted.

Wages

Wages – It is a paper form which you will have to keep your employees ready for distributing for the government. Your company will likely be accountable for having to pay taxes if they do not file the correct forms. You will find particular needs that must be followed and the right forms and paperwork must be submitted to be able to file the suitable forms.

Business Benefits

Business Benefits – This type of paper form is easy to study and easy to utilize. It is a good alternative for companies to utilize to possess an excellent degree of accuracy. As a way to steer clear of issues with payroll, the employees must understand how to fill out the suitable forms and file to the suitable forms.

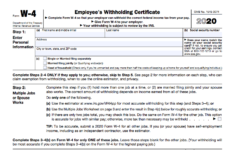

W4 Form Printable, Fillable 2019 & 2020

- Click Here to Download 2020 W-4 Form, Employee’s Withholding Certificate.

- Click Here to Download 2020 W-4 Form (Spanyol), Employee’s Withholding Certificate (Spanish version).

- Click Here to Download 2020 W-4P Form, Withholding Certificate for Pension or Annuity Payments.

- Click Here to Download 2020 W-4S Form, Request for Federal Income Tax Withholding From Sick Pay.

- Click Here to Download 2019 W-4 Form, Employee’s Withholding Certificate.

- Click Here to Download 2019 W-4 Form (Spanyol), Employee’s Withholding Certificate (Spanish version).

- Click Here to Download 2019 W-4P Form, Withholding Certificate for Pension or Annuity Payments.

- Click Here to Download 2019 W-4S Form, Request for Federal Income Tax Withholding From Sick Pay.

- Click Here to Download 0218 W-4V Form, Voluntary Withholding Request.