Table of Contents

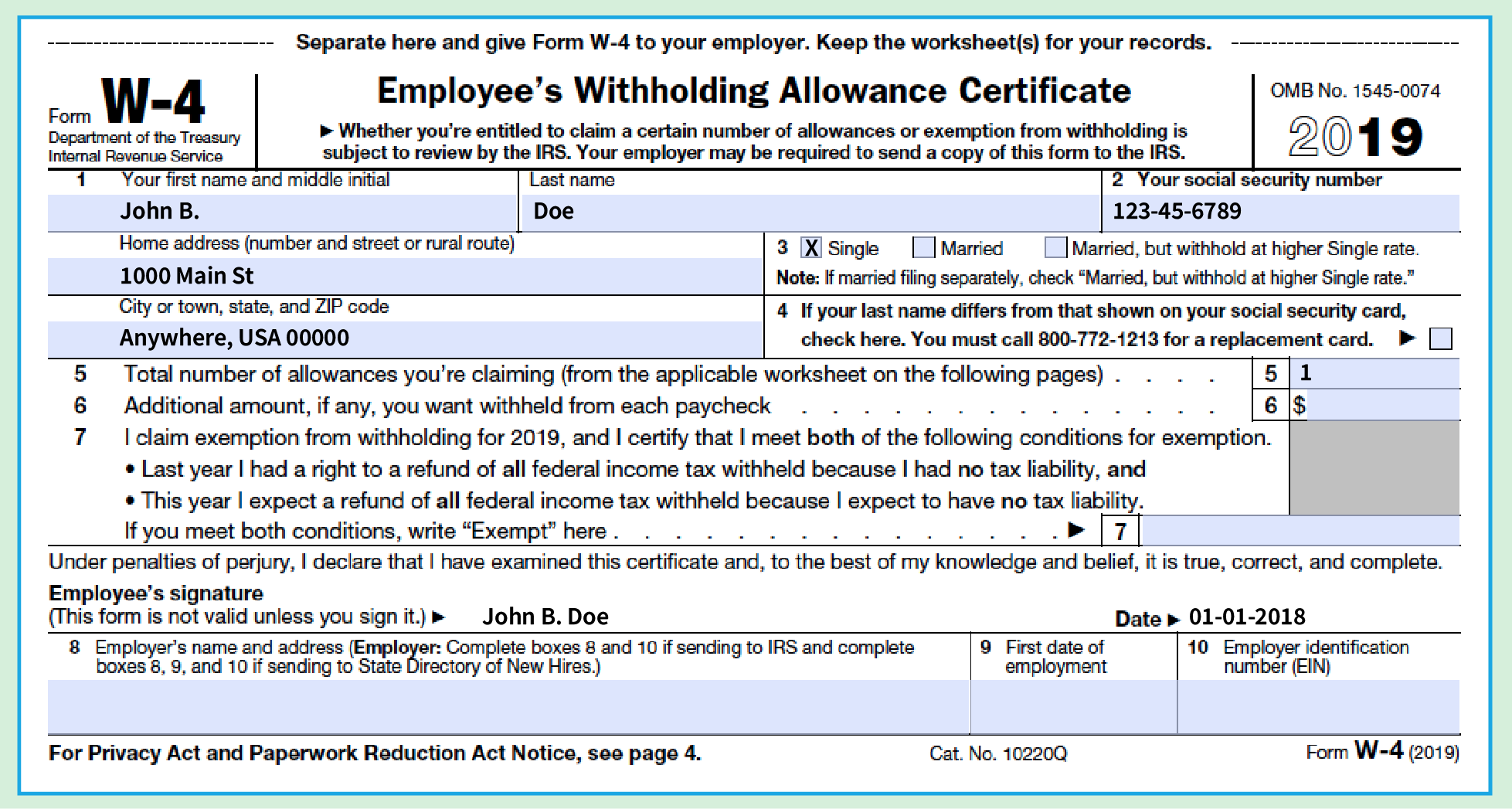

IL W-4 2021 Form Printable – The W4 Form 2021, also known as “Employee’s Withholding Certificate”, is an IRS form that employees use to inform their employers how much tax they will withhold from each and every paycheck. Employers use the IL W-4 2021 Form Printable to calculate specific payroll taxes, and to remit taxes to the IRS or the state on behalf employees.

In the event you have an existing W-4 form, you don’t have to fill it out. A new W-4 is not needed every year. The new W-4 will likely be required should you are starting a brand new job, or altering your withholdings at an present occupation. It really is an excellent justification for you to examine your withholdings.

The W-4 Form Has Been Updated

IL W-4 2021 Form Printable. Employees utilized to be capable of assert allowances on W-4 to cut back federal earnings tax withheld from wages. Employers would withhold much less from workers who claimed much more withholding allowances than they did. The 2017 Tax Cuts and Work Act altered plenty of tax guidelines. It also eliminated individual exemptions. The IRS changed the W-4 form as a outcome.

In 2020, the brand new W-4 was launched. It nevertheless requires simple personal information, but does not request for just about any additional allowances. Workers who wish to reduce their tax withholding can now assert dependents or utilize the deductions worksheet.

How to Fill Out a W-4 Form

The IRS web site has IL W-4 2021 Form Printable. They’re the steps to follow to find out if your scenario is roofed.

Step 1: Personal Information

Enter your name, address, and tax-filing status.

Step 2: Create An Account For Several Employment

Keep to the below instructions to determine how precise your withholding is if you have a lot more than one work or if you file jointly with your spouse.

Single and working multiple jobs or married filing jointly.

- A W-4 is necessary for each and every job.

- Fill out the W-4 steps 2 through 4(b) to get the highest-paid job. For other employment, leave these steps empty on the W-4s.

- In the event you are married and jointly file, you can tick a box to point how much you generate. This is the trick: Each partner need to do this on their W-4s.

You will find several choices should you don’t need your employer to know that you simply have a very 2nd work or that you simply make income from non-job sources.

- Line 4(c) allows you to instruct your employer that an extra sum of tax be withheld from your paycheck.

- Alternativly, you can’t include the additional income in your W-4. Rather than having to pay tax directly from your paycheck, ship the IRS believed quarterly tax payments.

Step 3: Assert Dependents, Children Included

If your earnings is lower than $200,000, or $400,000 should you file jointly, you can enter the quantity of dependents and children you’ve and multiply these from the credit sum. To learn more concerning the child credit and once you can declare tax dependents, remember to refer to the next.

Step 4: Alter Your Withholdings

You are able to reveal that you simply would love additional tax withheld, or for being suitable for deductions over and above the normal deduction.

Step 5: Sign Your W-4 And Date It

After you have finished the form, deliver it to your employer’s payroll or human sources team.

What Do You Need To Know A Few New W-4 Form?

Your employer will not ship the IRS form W-4. The business will file the W-4 right after making use of it to compute your withholding. The brand new W-4 form is simply needed if your employment changes in 2021, or you wish to modify the quantity withheld from you pay out.

You could have to amend your IL W-4 2021 Form Printable if you get married, divorced, add a child to the family, or consider up a second work. Should you find that your withholdings have been as well high or low the earlier year, you could need to file a brand new W-4. After your business updates your payroll info, your W-4 changes will be efficient within one to three pay periods.

IL W-4 2021 Form Printable

Loading...

Loading...