Table of Contents

California W4 Form – The W4 Form 2021, also referred to as “Employee’s Withholding Certificate”, is an IRS form that workers use to inform their employers simply how much tax they will withhold from each paycheck. Employers make use of the California W4 Form to compute particular payroll taxes, and to remit taxes for the IRS or perhaps the state on behalf employees.

Should you have an existing W-4 form, you don’t need to fill it out. A new W-4 is not required each and every year. The brand new W-4 will be needed should you are starting a fresh occupation, or adjusting your withholdings at an current work. It really is a great justification for you to check your withholdings.

The W-4 Form Is Updated

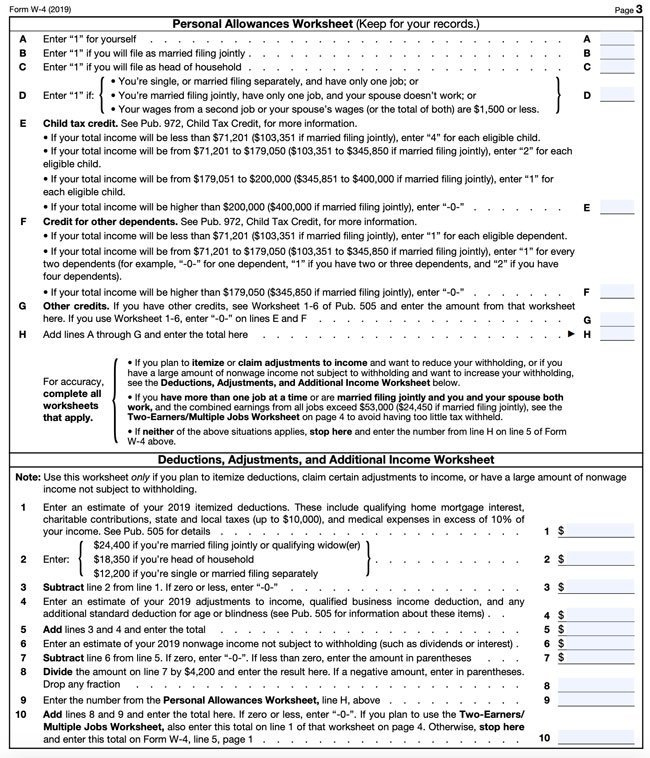

California W4 Form. Workers utilized to have the ability to declare allowances on W-4 to scale back federal earnings tax withheld from wages. Employers would withhold much less from employees who claimed more withholding allowances than they did. The 2017 Tax Cuts and Jobs Act changed lots of tax guidelines. In addition, it removed personal exemptions. The IRS modified the W-4 form like a outcome.

In 2020, the new W-4 was launched. It nonetheless needs simple private details, but does not inquire for almost any further allowances. Employees who desire to scale back their tax withholding can now assert dependents or utilize the deductions worksheet.

How to Fill Out a W-4 Form

The IRS web site has California W4 Form. These are the actions to adhere to to determine if your circumstance is roofed.

Step 1: Personal Information

Enter your name, address, and tax-filing status.

Step 2: Create An Account For Multiple Work

Keep to the beneath guidelines to determine how precise your withholding is if you’ve got more than one occupation or should you file jointly with your spouse.

Single and working multiple jobs or married filing jointly.

- A W-4 is needed for every job.

- Fill out the W-4 steps 2 through 4(b) to acquire the highest-paid work. For other jobs, go away those steps empty around the W-4s.

- If you are married and jointly file, you are able to tick a box to indicate how much you earn. This can be the trick: Each partner must do that on their W-4s.

You will find a couple of choices should you don’t want your employer to understand that you have a second occupation or that you simply generate income from non-job sources.

- Line 4(c) allows you to instruct your employer that an extra quantity of tax be withheld from your paycheck.

- Alternativly, you cannot contain the additional revenue in your W-4. Instead of paying tax straight from your paycheck, send the IRS estimated quarterly tax payments.

Step 3: Claim Dependents, Kids Included

If your earnings is lower than $200,000, or $400,000 in the event you file jointly, you’ll be able to enter the quantity of dependents and children you’ve got and multiply these through the credit sum. To find out more regarding the child credit and once you can claim tax dependents, please consult with the subsequent.

Step 4: Adjust Your Withholdings

You can reveal which you would like additional tax withheld, or to become eligible for deductions past the normal deduction.

Step 5: Sign Your W-4 And Date It

When you have accomplished the form, send it to your employer’s payroll or human assets group.

What Do You Have To Know A Few New W-4 Form?

Your employer will not likely ship the IRS form W-4. The business will file the W-4 following utilizing it to determine your withholding. The new W-4 form is just needed if your employment changes in 2021, or you wish to change the quantity withheld from you pay.

You may have to amend your California W4 Form should you get married, divorced, incorporate a child towards the loved ones, or take up a 2nd occupation. In the event you discover that your withholdings had been as well high or low the earlier year, you could need to file a brand new W-4. Following your company updates your payroll information, your W-4 changes will probably be efficient inside one to three spend durations.

California W4 Form

Loading...

Loading...