Table of Contents

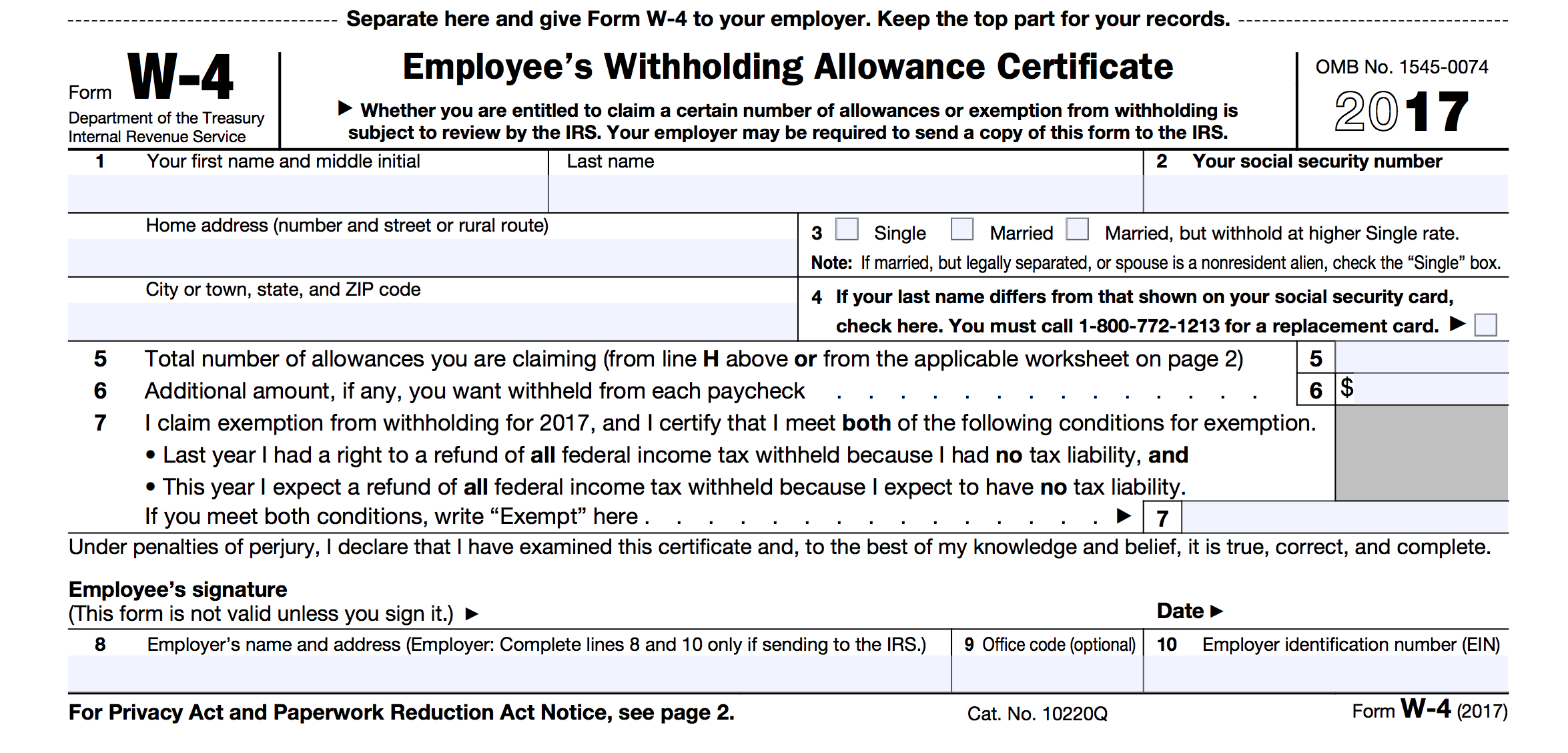

2022 W4 Printable Form – The 2022 W4 Form is an tax related form provided from the Internal Revenue Service. It’s used to figure out the number of money withheld from a person’s pay check to pay their federal income taxes. By completing this form correctly, you will stop owing tax or paying taxes in excess due to IRS.

What Is The Purpose of The 2022 W4 Form – IRS W4 Form?

Anyone who qualifies as a taxpayer in the United States will be expected to pay taxes to the IRS upon earning income for the whole year. There are a variety of income categories that aren’t tax-deductible but , in the majority of instances there is a high probability that you’ll have to declare and pay taxes at the top of your federal tax bill.

In order to make sure that the taxpayers collect the correct amount of tax In order to ensure that the taxpayers pay the right amount of tax, the IRS requires them to provide documentation each time they’re hired to a new job. The document includes the 2022 W4 Printable Form that is, in fact, the most crucial document in the subject. The IRS makes use of this particular document to obtain pertinent information on the income of taxpayers. Additionally, it is used by employers to calculate the amount of withheld federal income tax out of every paycheck of their employees.

Paying a less amount of government income tax that you are expected to be could cause you to problems such as tax and penalty charges. In contrast the higher tax withheld could result in a refund during the tax return process. Although you might think it is nice to receive the money back, it actually results in more money in your pay. Consequently, the extra payments will be included in your yearly income tax bill you must to file for the following year of the tax return.

What Changes Made of The 2022 W4 Form – IRS W4 Form?

The past W4 Form was based as part of the withholding allowances system. It required taxpayers to submit an form when they have to adjust their tax withholding or begin the process of obtaining a new job. From 2020, the IRS altered the way they calculate tax withholding to simplify the process of calculating the withheld amount from every single pay check. The form is also redesigned in order to make it easier to understand and increase the accuracy of the system.

The essential information carried by the 2022 W4 Printable Form stays the same regarding which design you use. However, you may prefer the new form because it’s simpler questions. By using more easy worksheets, the likelihood of calculating your withheld amount of tax taken from your pay packet is improved and.

Note that you have to change your 2022 W4 Printable Form each time you have changes in your income or major alteration in your life. This can help you pay taxes only on the amount that you owe. This is beneficial in the long term. It could also assist you receive a larger annual tax refund because the withheld tax impacts the tax refund directly.

W-4 Form 2022 Printable, Fillable

Loading...

Loading...