Table of Contents

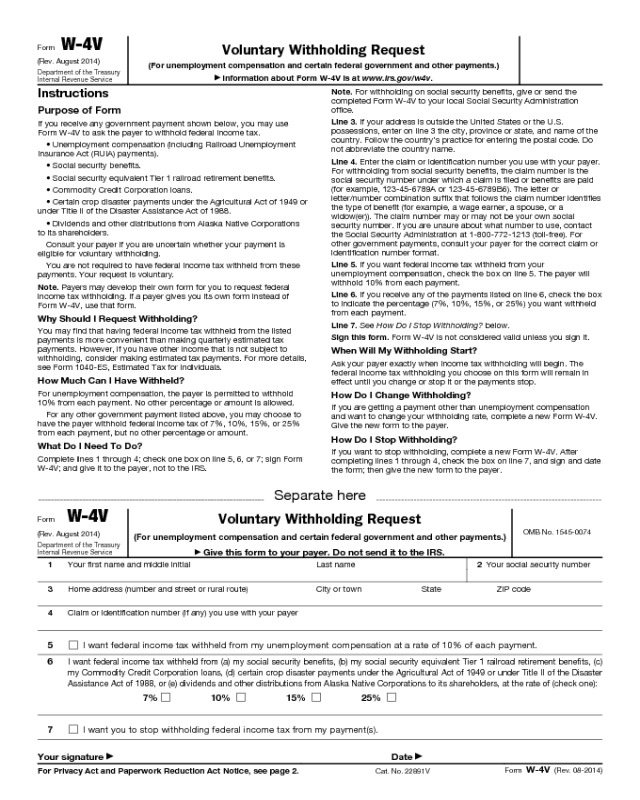

Social Security Tax Withholding Form W-4V 2021 Printable – The Social Security Tax Withholding Form W-4V 2021 Printable is used to request that your payer withholds federal income tax.

What is The W-4V Tax Form?

Voluntary withholding request, IRS Form W-4V is accustomed to ask for that the payer withhold federal tax. In the event you get one of such government benefits, it is possible to apply it:

- Social security rewards;

- The Tier 1 Railroad Retirement Advantages are equivalent to Social Security. These contain annuities, unemployment-sickness and survivor programs that railroad employees and their family members can entry;

- Compensation for unemployment;

- Commodity Credit Corporation Loans-These loans are made through the Agriculture Department to keep up, stabilize and sustain farm incomes and agricultural costs;

- Alaska Native Firms distribute dividends and other payments to shareholders;

- Crop catastrophe payments beneath Title II of either the Disaster Help Act of 1998 or perhaps the Agricultural Act of 1949 – This economic support is produced when a organic disaster results in stock reduction or stopped planting or inadequate yields;

- The Internal Revenue Service (IRS), issued the most present version from the form, dubbed the IRS Voluntary Withholding request, on February 1, 2018. This rendered all earlier versions obsolete.

How Do I Total the W-4V Form?

You could ask your payer to withhold federal taxes once you very first seek advantages or payment. You do not need to do this, however you can full the W-4V Form at a afterwards time if you want to start withholding. This form enables you to established the withholding proportion that you’d like. It’ll continue to be in result till payments quit or until you modify it by filling out a new form.

Here is how you can complete the IRS Voluntary withholding Request Form:

- You can also use this form to ask for withholding taxes. You might be necessary to make use of the form provided by your payer;

- The IRS need to be submitted through the payer, and not to the IRS;

- To ask for that the social security payments be withheld, remember to submit a accomplished form W-4V towards the local Social Security Administration office;

- You have to speak directly in your payer as a way to determine when the earnings tax withholding commences;

- You are able to modify your withholding charge by submitting a brand new W-4V form or stop the process entirely.

Instructions For Filling Out the W-4V Form

- Make sure you reveal your total lawful name and SSN;

- Consider a be aware of one’s house address;

- Enter the assert number or identification number of one’s payer. This might be your social security number;

- You are able to indicate regardless of whether you’d like federal earnings tax to become deducted from unemployment payments. The payer will then deduct 10% from every payment;

- You are able to choose which share of further government benefits you’d probably like withheld from your advantages, whether or not it really is 7 %, 10 %, 12 percent or 22 percent;

- In the event you desire to stop withholding, check the right option;

- You have to sign and date the form.

Social Security Tax Withholding Form W-4V 2021 Printable

Loading...

Loading...