Table of Contents

Directions For Filing W-4V – The Directions For Filing W-4V is used to request that your payer withholds federal income tax.

What is The W-4V Tax Form?

Voluntary withholding ask for, IRS Form W-4V is used to ask for that the payer withhold federal tax. If you obtain one of such government rewards, it’s feasible to put into action it:

- Social security benefits;

- The Tier 1 Railroad Retirement Rewards are comparable to Social Security. These contain annuities, unemployment-sickness and survivor applications that railroad workers and their families can access;

- Compensation for unemployment;

- Commodity Credit Company Loans-These financial loans are created from the Agriculture Department to maintain, stabilize and sustain farm incomes and agricultural costs;

- Alaska Indigenous Firms distribute dividends and other payments to shareholders;

- Crop catastrophe payments beneath Title II of both the Disaster Help Act of 1998 or even the Agricultural Act of 1949 – This financial support is created when a all-natural disaster final results in inventory decline or stopped planting or poor yields;

- The Internal Revenue Service (IRS), issued the most current edition of the form, dubbed the IRS Voluntary Withholding request, on February 1, 2018. This rendered all earlier variations out of date.

How Do I Total the W-4V Form?

You could ask your payer to withhold federal taxes whenever you first look for benefits or payment. You don’t must do that, but you can total the W-4V Form at a afterwards time if you want to start withholding. This form allows you to established the withholding share that you want. It’ll continue to be in effect till payments stop or till you modify it by filling out a brand new form.

Here is how to complete the IRS Voluntary withholding Request Form:

- You can also use this form to request withholding taxes. You may be necessary to make use of the form offered by your payer;

- The IRS should be submitted from the payer, and not to the IRS;

- To request that your social security payments be withheld, please submit a accomplished form W-4V for the neighborhood Social Security Administration office;

- You must speak immediately to your payer as a way to determine if the income tax withholding begins;

- You’ll be able to modify your withholding rate by filing a fresh W-4V form or stop the procedure completely.

Guidelines For Filling Out the W-4V Form

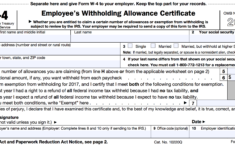

- Make sure you indicate your full lawful name and SSN;

- Consider a be aware of your residence address;

- Enter the assert number or identification number of the payer. This could be your social security number;

- You can reveal regardless of whether you would like federal revenue tax to be deducted from unemployment payments. The payer will then deduct 10% from each payment;

- You’ll be able to pick which proportion of further government advantages you’d probably like withheld from your rewards, whether or not it’s 7 %, 10 percent, 12 per cent or 22 per cent;

- In the event you wish to stop withholding, check the right option;

- You have to sign and date the form.

Directions For Filing W-4V

Loading...

Loading...