Table of Contents

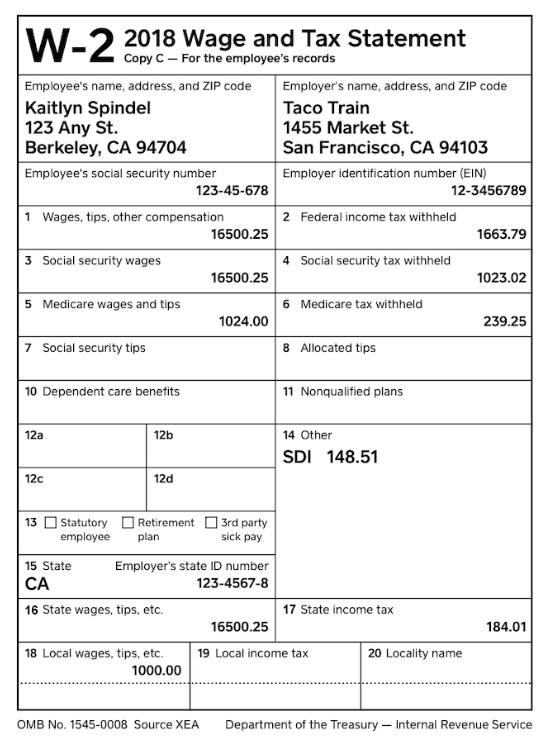

W2 Forms 2020 Printable – Since the utilization of paper forms and papers proceeds for being a staple of business and commercial routines, there is certainly a necessity for organizations to make utilization of the W4 form printable. The W4 form printable is utilized to aid an employee’s withholding of tax funds as well as other sorts of payroll transactions.

The W4 form may be used to file all essential paperwork and forms pertaining to employee withholding. In the event you are a business that handles taxes for other people or other government agencies, then you will find the W4 form printable to become very helpful.

Here are a few from the benefits that can originate from using this type of paper form:

- Payroll

- Tax Savings

- Employee’s Withholding Certificate

- Wages

- Business Benefits

Payroll

Payroll – This really is something that can be extremely difficult for the workers to accomplish without assistance. Without understanding how to fill out these forms correctly, it’s fairly possible that the employee won’t get paid at all. You are going to have the ability to steer clear of any authorized problems if you know how to file these forms correctly.

Tax Savings

Tax Savings – Once you know how to manage payroll by yourself, then you definitely will be able to preserve a lot of money on taxes. Should you hire a payroll service, you’ll be responsible for paying the payroll taxes on behalf in the business. In the event you are an employer, then you definitely must pay those payroll taxes on your own. You will have the ability to save money using this sort of help.

Employee’s Withholding Certificate

Employee’s Withholding Certificate – This form is actually a extremely essential one that all employees must post once they turn out to be utilized. It is essential for the company to ensure that their employees do not withhold cash from the company’s account. This may become a problem in the event the employee will not realize the right approach to withhold. This is also some thing that is extremely difficult to understand how to file for, simply because there are particular types of deductions that workers can make too as specific types of wages that may be deducted.

Wages

Wages – This is a paper form that you simply must keep your staff well prepared for distributing towards the government. Your organization will likely be responsible for having to pay taxes if they don’t file the correct forms. You’ll find specific requirements that must be adopted and the proper forms and paperwork have to be submitted to be able to file the suitable forms.

Business Benefits

Business Benefits – This type of paper form is easy to go through and easy to use. It really is an excellent alternative for companies to use to have an excellent degree of accuracy. As a way to avoid problems with payroll, the employees will have to know the way to fill out the right forms and file to the proper forms.

W4 Form Printable, Fillable 2019 & 2020

- Click Here to Download 2020 W-4 Form, Employee’s Withholding Certificate.

- Click Here to Download 2020 W-4 Form (Spanyol), Employee’s Withholding Certificate (Spanish version).

- Click Here to Download 2020 W-4P Form, Withholding Certificate for Pension or Annuity Payments.

- Click Here to Download 2020 W-4S Form, Request for Federal Income Tax Withholding From Sick Pay.

- Click Here to Download 2019 W-4 Form, Employee’s Withholding Certificate.

- Click Here to Download 2019 W-4 Form (Spanyol), Employee’s Withholding Certificate (Spanish version).

- Click Here to Download 2019 W-4P Form, Withholding Certificate for Pension or Annuity Payments.

- Click Here to Download 2019 W-4S Form, Request for Federal Income Tax Withholding From Sick Pay.

- Click Here to Download 0218 W-4V Form, Voluntary Withholding Request.